28 Jun 2024

HNW investors quit in-person advisory services in favour of digital investment platforms

Convenience, accessibility and diversity in investments is eroding reliance on in-person advisory services according to Endowus, the Singapore-based fintech company, and one of the companies within our Prosus Ventures portfolio. Endowus recently launched their HNW Investor Sentiment 2024 report, providing a deep dive into the investment behaviors, preferences, and concerns of nearly 500 high-net-worth (HNW) investors from Hong Kong and Singapore.

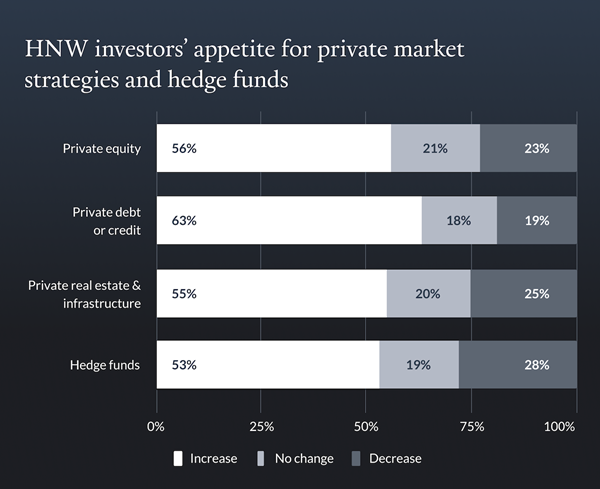

Against a backdrop of economic uncertainty, the report shows a significant shift towards private market strategies and hedge funds among HNW investors, driven by the desire for assets less correlated to public markets and the potential for higher returns.

Specifically, respondents are looking to increase asset allocation to private debit or credit (63%), followed by private equity (56%), private real estate and infrastructure (55%), and then hedge funds (53%).

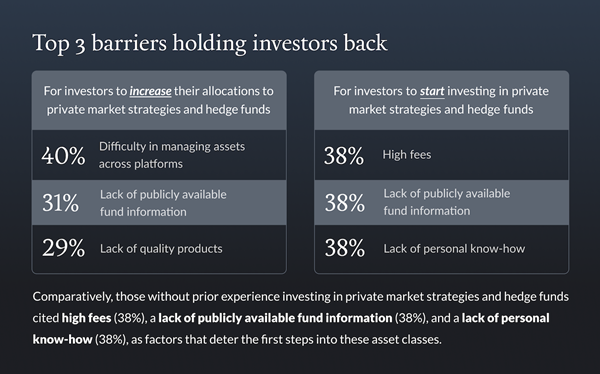

However, a notable lack of experience with these asset classes among investors suggests substantial barriers to entry, including high fees, a lack of transparent information, and challenges in managing diverse asset portfolios across different platforms. These challenges underscore the need for wealth management services that can offer personalised advice, transparent fee structures, and simplified access to a diverse range of investment strategies.

One standout finding from the report is the strong preference for digital platforms and online access for investing, including digital platforms and online private banking, which dominate as the preferred choices in both markets, accounting for 71% in Hong Kong and 66% in Singapore. This digital-first trend spans across all age groups, debunking the myth that older generations prefer traditional, in-person advisory services.

As a result, there is a growing demand for investment management solutions that offer convenience, accessibility, and a broad range of offerings through technology-driven platforms. These digital wealth advisory platforms are seen as highly relevant to private market and hedge fund investment strategies as they provide democratised access to these asset classes and can offer additional insights and meaningful advice.

On the wealth manager side, service quality, transparency in fees, and brand reputation are seen as important traits in wealth managers, with HNW investors in both markets emphasising the importance of trusted wealth managers who can offer sound advice, recommendations that align with their financial goals, and at a low, transparent cost.

Endowus Private Wealth emerges as a pivotal player in this evolving landscape. Its collaboration with over 80 global fund managers enables it to deliver expertly curated investment strategies across public and private markets, hedge funds, and alternatives.

Click here to download the Endowus HNW Investor Sentiment 2024 report and uncover new insights into today's private wealth management industry.